How Secular Humanists (and Everyone Else) Subsidize Religion in the United States

- rcragun

- 0

- on May 17, 2012

Citation: Cragun, Ryan T., Stephanie Yeager, and Desmond Vega. 2012. “Research Report: How Secular Humanists (and Everyone Else) Subsidize Religion in the United States.” Free Inquiry, 39–46.

You can download this article here.

(Image generated using DALL-E 3.)

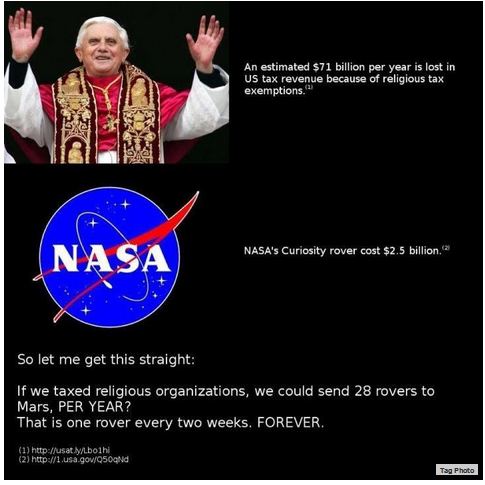

This article has inspired several infographics:

Not sure who created these. If you know who did, please let me know so I can give them credit.

I was recently asked by a middle school student to answer some questions about religions and tax exemptions. Since I spent a bit of time answering those questions, I thought it might be useful to post the questions and answers here.

Q: Is it fair that churches get to not pay taxes?

A: This is a somewhat challenging question for me to answer as it requires me to balance between the logic of equality and my own personal opinions. As a college professor and researcher, I try to keep my opinions out of a lot of my work, as my work should be driven by theory and data, not by my opinions. So, I’ll do my best to answer this question without bringing my personal views into the issue.

Religions in the US are not required to pay certain taxes. You can find most of the taxes that they do not have to pay in my article on this topic, which is available here. Whether or not it is fair that religions do not have to pay taxes requires examining a number of assumptions about fairness. Determining fairness is always a question of, “Is it fair to whom?” For many religious people, who derive some benefit from religions, they may consider this to be fair, since they believe that what religions do is provide a vital and helpful service. However, for nonreligious individuals, this is not fair, since religions do not provide them services and, in fact, in many instances may actually cause them harm by organizing initiatives that restrict their rights (e.g., by organizing opposition against transgender rights, like was just done in North Carolina). In short, from the perspective of the nonreligious, religions not having to pay taxes is unfair because religions do not provide them any direct benefits and may, in fact, lead to harm for them.

An analogy may be a helpful illustration here. Imagine at your school that the principal decided to implement a new policy. The new policy is that any student who has French ancestors gets lunch for free every day, while everyone else has to pay the full price. The principal defends this policy by claiming that people of French ancestry have done a lot of good for the world, so everyone else should have to subsidize their lunch. If you happen to be French or have French ancestors, this is a great deal – you get free lunch. But if your ancestors are from Ireland, is this fair? Certainly the Ireish have done a lot of good for the world, too. Why should only those with French ancestry get a free lunch? And, keep in mind, the lunch that is being given to those with French ancestry isn’t really free – it’s being paid for by everyone else.

The situation with religions in the US is similar. Some people benefit from religions, but many people (about 23% of the adult population in the US) do not. Religions, however, don’t pay taxes that pay for fire fighters, police, military, libraries, education, the criminal justice system (i.e., courts and prisons), the federal, state, and local governments, etc. Yet, religions get all of the benefits of those public services. Who, then, pays for those services? Somebody pays for them, but religions don’t. That’s a lot like French kids in your school getting a “free” lunch, which is really paid for by all the other kids. So, no, I don’t think it is fair that churches don’t have to pay taxes.

Some people may counter by saying that institutions that provide education or charitable services or scientific services are also tax exempt. That is true. But it is much easier to argue that such institutions are universally beneficial than it is to argue that religion is universally beneficial, especially since only about 20% of Americans attend religious services weekly. The billions that religions avoid paying in taxes every year go to help a small percentage of the American population, not the majority of Americans.

Q: Why do you think that priests get to live for free in million dollar houses and not pay taxes since they work for the church? Do you think that is fair?

A: Technically, clergy don’t get to live for free, though it depends a lot on the religions. Clergy, in the US, do get a parsonage exemption. The parsonage exemption means they can reduce their taxable income by the amount they spend on the upkeep of their primary residence, including everything from the mortgage to refinishing the pool. But they don’t technically get to live for free – they pay all those costs, but the government helps to subsize that by reducing their taxes as a result. If clergy have no income, as is the case with nuns and monks who take vows of poverty, then they may not pay taxes. Otherwise, if they have an income, they do pay taxes. They may be able to avoid paying Social Security taxes, but they are then not entitled to Social Security benefits. So, yes, they pay taxes, but they get a discount that is exclusively only to clergy.

Do I think this is fair? Again, no. My logic is the same as for above: clergy only benefit a small subset of the US population. Additionally, they get paid to provide a service – religious or spiritual care for those who want it. As an educator, I, too, get paid to provide a service, but I pay taxes for it. I don’t think clergy should be seen as any different from other employees of nonprofit organizations, none of whom get tax deductions for their housing expenses.

Q: Should churches pay taxes? Why?

A: I answered this with my first response. I think they should because they are not charities and do not provide services that benefit everyone. To the contrary, they actually cause a great deal of harm (as attested by the thousands of people who kill themselves every year in the US because they feel like they have sinned or are unable to live up to the teachings of their religion). Why we should give tax breaks to institutions that benefit only some and harm others makes little sense to me. However, for the religions that do provide charitable services, like soup kitchens, I think the soup kitchen portion of the religion should be separated from the rest of the religion and be treated like other charities. Those portions should not pay taxes. The rest of what religions do – providing religious/spiritual services for people – should be taxed, just like fraternal orders or movie theaters are taxed.

Q: Do you think that the churches would struggle if they were not tax-exempt? Yes or no?

A: I think many would. There are lots of churches in the US that have declining memberships, yet they still meet in multi-million dollar buildings. If they had to pay property taxes on those buildings, they would quickly go out of business, because the taxes would be so high. But that would also be a reflection of the desires of the marketplace. If there is not enough demand for a service, then why should the government using everyone else’s tax dollars subsidize the service? The service should simply disappear, just as demand has.

Again, an analogy may work here. There are some people who still have landline telephones. But those are disappearing as more and more people have cellphones. And even those few landline phones that still exist are now largely using the internet for the service, not outdated telephone lines. Should those of us who don’t use landline phones have to pay for the few people who want to keep their landline phones when these are disappearing and outdated? I don’t think we should, and neither does the government, which is why it has taken that subsidy away. I’m fine subsidizing internet access for people who live in rural areas, as that is an important service. But I see no reason why we should subsidize landline phones now that they are outdated. The same goes for religion.

Q: Do you think that the priest should put some of their salary in the donation bucket?

A: Most clergy would argue that they are already doing charitable work, so they should not. Additionally, since the donation bucket actually raises the funds to pay the clergy, this is somewhat counter-productive: they can’t really pay themselves, can they? Of course, the salaries of clergy vary widely in the US. Some clergy make millions, while others are volunteers. I think your real question is probably more like: Do some clergy make too much money? I think the answer to that is a very obvious: Yes.

Q: Should the IRS be able to take away a church’s tax exemption?

A: Technically, the IRS can already do this. However, it doesn’t do it very often (if ever) because of a lack of political will in the US. So long as religion remains normative (meaning, most people think religion is good), the IRS will continue to do nothing when it comes to removing tax exemptions from religions. Their needs to be political will in order to make that happen.

You may also be asking if the IRS has the power to take away all of the religious tax exemptions. Technically, no, it does not. That would have to be done by Congress. Again, that would require political will or desire, which is not going to happen any time soon as there remains a pro-religious bias in the US, even though the minority of Americans attend religious services and 1/4 Americans don’t even consider themselves religious.

Q: Why do you not support the church being tax-exempt?

A: Interestingly, this assumes that I would not. Conveniently, I don’t. I detailed why in my previous answers.

Q: Would there be a major increase in tax or not that big of an increase at all?

A: In a rather superficial estimate of tax subsidies in the US, I came to the conclusion that religions would add about $71 billion per year in additional tax revenue if they lost all of their exemptions. I think that is a substantial under-estimate. The real number is probably double or triple that amount. So the answer is: there would be a major increase in taxes at the federal, state, and local level if religions lost their tax exemptions. The increased tax revenue would be enough to solve both hunger and poverty issues in the US.

Q: Should the church have a limited amount of strikes if they break the rules of talking in the church about the government then therefore losing the church’s tax exempt status?

A: I think you’re referring to “politicking from the pulpit” with this question. Technically, they should have zero strikes, as the law is written. Church’s are not legally allowed to endorse candidates. Doing so is a violation of the law and they should immediately lose their tax exemption. However, there is no political desire to enforce this law at the present time, meaning thousands of churches in the US are in flagrant violation of the law and nothing is done about it. My views on this are complicated and detailed in my most recent book, How to Defeat Religion in 10 Easy Steps.

Q: When did you get involved in this not so major controversy?

A: I have been studying religion for a long time. I grew up religious and did my best to study it in college. However, it was really when I went to graduate school in 2001 that I began to study religion social scientifically. I completed my PhD in 2007 and continue to research religion. As for looking specifically at the issue of religious tax exemptions, that began in 2012 with the article I linked to above, How Secular Humanists (and Everyone Else) Subsidize Religion in the United States. I remain very interested in this topic.